News

Order in the Chaos, some strategic FM sourcing models

Outsourcing of Facilities Management contracts is not new to the New Zealand FM profession.

There are several procurement websites where contracts are tendered, especially in health care, government and education. Client organizations are exploring more mature FM service delivery models although the New Zealand Procurement psyche is still very costs orientated and lacks value driven orientation and or specific FM procurement templates. I’ve observed some immature FM contract procurement tenders in the last 5 years and strengthened my appetite to provide some order in the views on more mature FM models in New Zealand.

There are several sourcing concepts and models for Facilities Management: self-delivery, single service outsourcing, multi-service outsourcing, managing agent and Integrated Facilities Management (IFM), just to name a few. Especially the managing agent and the IFM model create some confusion. In this article we try to create some “order in the chaos” by highlighting the pros and cons of these sourcing models. In the daily reality of FM we observe combinations of the models mentioned in this article, but all FM contracts can be simplified to one of the three arch type models described in this article.

Managing agent

In the managing agent model, the client contracts the service contractors as well as the managing agent. The managing agent is responsible for the day to day operational coordination en management of the service contractors. The managing agent often provides location managers and a helpdesk. The scope of the responsibilities of the management agent is rather wide. In some cases the managing agent also offers operational and tactical contract management responsibilities, manages the procurement process of operational service suppliers and/or delivers operational contract services (eg. cleaning, security, catering).

The most important argument for advocates of this model is the autonomy in the supply chain. Clients select independently their service providers or are actively involved. This results in more transparency for the client, especially related to the costs of the operational service providers. Another important advantage is the variance in service providers, and as a result that contracts can vary in time and thus provide flexibility in service provider mix. The contract with the managing agent can be terminated whilst the contracts with the individual service providers continue. This simplifies transitions and reduces the client’s contract risks base. Above advantages are similar with the advantages of a more strategic focus on outsourcing (high split), namely more focus on creating value for the wider business and a more strategic focus on facilities management.

This sourcing model has of course disadvantages. The most common disadvantage is financially of nature: as well as the managing agent as the operational service contractors expect a commercial margin. Another risk is that the managing agent and service contractors can deny responsibility or try to transfer responsibility to one and each other as the managing agent is not the “owner” of the contracts with the service contractors. Another disadvantage is the widespread of contracts with individual service contractors and none of them are responsible for an integrated approach or value delivery. The managing agent can play an important part to achieve this integration based on their contract KPI’s. But the managing agent can easily defer responsibility to the client, as they have not selected the individual service contracts and probably are not empowered in their contract to create the optimal service contractor mix.

| Pro's | Con's |

|---|---|

| Managing agent provide missing competences at client site | Cross over on management and administration between managing agent and service providers as well as client and managing agent |

| Contracts with specific service providers (individual service providers as well as managing agent) can be terminated independently of other service provider contracts (reduction of dependencies) | Responsibilities between managing agent and service providers are unclear. Parties can blame each other and diffuse responsibility on delivery |

| Client keeps full control on sourcing contracts with all relevant service providers | Margin on margin on overhead, revenue and risk |

| Client can focus on value creation for the wider business and on strategic FM | Integration of service delivery at risk due to multiple single service providers being contracted individually |

| Client has high level of influence on service delivery and performance, compared with IFM, as (majority of ) strategic FM is not outsourced | Administration of single service contractors not integrated and separately managed |

| Lots of coordination and management required by client due to multiple single providers, although this can be delegated to managing agent | |

| Lack of economies of scale in sourcing due to single service provider contract approach |

Integrated facility management

Integrated facility management (IFM) has 2 main types; operational services are fully outsourced to subcontractors (subcontracted IFM) or the IFM contractor delivers the services with their own staff (self-delivery IFM).

In this sourcing model the client contracts to one service provider. Operational service delivery as well as operational and tactical management tasks are outsourced only to this one service provider. The IFM service provider outsources the operational service delivery to multiple service providers but is responsible for the integrated service delivery of these service providers. The service scope can vary from wide (soft services, hard services, record management, property management etc.) or small by only managing the soft services. The operational and tactical management tasks of the IFM service provider can vary in operational client engagement (Helpdesk or self-service portal), location management, administration, reporting and contract performance management, tactical sourcing and contract management of the individual service providers, service design, project management and more tactical end-user client management.

Typical for this subcontracted IFM model is that the IFM service provider fully focusses on the tactically/strategically management of the service providers and empowers them to deliver these operational services. The IFM service provider is independent of the FM service supply chain and as such consult and engage with the client organization to ensure the best in class service provider mix. In reality we see that IFM service contractors have developed a supply chain with preferred best in class FM service providers. A disadvantage of this model (similar to the managing agent) is that the integrated FM approach can be frustrated by a high number of individual service providers. Another risk is the “margin on margin” factor. In reality, this model is not likely more expensive than an in-house self-delivery model. In this model IFM service providers have extensive knowledge of market rates, good overview of best in class service providers and are able to negotiate value in their supply chain (financial and non-financial advantages).

Below a summary of the pros and cons of this model:

| Pro's | Con's |

|---|---|

|

IFM service provider is integrally responsible for the performance/delivery by individual service providers |

Cross over on management and administration between IFM and individual service providers |

|

Client has some influence on choice of individual service providers but less as in managing agent model |

Integration of service delivery at risk due to multiple single service providers being contracted individually |

|

IFM service provider can provide competences missing at client side |

Extension of the FM supply chain by the appointment of the IFM service provider (another layer of communication and coordination |

|

Transaction costs client are relatively low as only IFM service provider is contracted |

Less operational focus of IFM service provider |

| Independence in the supply chain | Specific arrangements to be considered in relation to transfer of staff between client, IFM and individual service providers |

|

More strategic focus from IFM service provider |

Loss of operational FM knowledge at client site |

|

Small strategic FM capability required |

Cross over on management and administration between IFM and individual service providers |

Self-delivery IFM

Self-delivery IFM differentiates from the subcontracted IFM model by delivering the operational services themselves! The IFM provider is thus less dependent from individual service providers and can directly manage operational processes and delivery. Integration of service delivery should be easier and improved by the creation of multifunctional teams and empowering to manage multiple processes and service areas. This model is similar to the IFM subcontracting model as far as the tactically/strategically management focus goes.

Self-delivery IFM is not existing in its purest form as there are no FM service providers who can manage the full scope of FM, with their own employees and as such there always some sort of outsourcing of services is required. For example outsourcing of vending machines, technical design, asset management, security, cleaning and grounds maintenance or pest control.

Main risk of this sourcing model is the so called “vendor lock in”: it’s difficult to transfer the IFM service contractor as all operational services have to be transferred to another IFM contractor. The transition complexity and associated risks are relatively big that many client organizations struggle to end the “partnership”.

Below a summary of the pros and cons of this model:

| Pro's | Con's |

|---|---|

| IFM service provider is integrally responsible for the performance/delivery | Not always best in class operational service delivery as IFM service providers is not completely independent of supply chain |

| Opportunity to integrate services | Risk of “vendor lock in” |

| IFM service provider can provide competences missing at client side | Loss of operational FM knowledge at client site |

| Transaction costs client are low as only IFM service provider is contracted | More operational IFM focus |

| None or less overlap in management, administration, systems and processes between IFM and individual service providers | Not always best in class operational service delivery as IFM service providers is not completely independent of supply chain |

| No gaps between “operational service delivery” | Risk of “vendor lock in” |

| Ownership of data and systems with only one provider (IFM) | Loss of operational FM knowledge at client site |

The IFM model is not new in New Zealand as well as the managing agent model. Both models have been around for a while and little market data is available on the percentage of market share of providers as well as client organisations chosen for one of these models. Undoubtedly many “war stories” will float around of success and failure stories, especially in a New Zealand FM market finding its way on the FM maturity ladder! But many executive C-suite members lack knowledge in the opportunities of IFM. Especially the larger multi-nationals feel more comfortable with IFM models. Some of the arguments that they choose for IFM are:

- FM is not part of core business;

- Interdependencies between core business and FM processes are limited;

- FM is professionally organised and mature and IFM is the logical next maturity step;

- Extensive knowledge of strategic sourcing in the organisation (value driven and not only cost driven);

- Outsourcing is based on partnership relationship and less “transactional” ;

- Cost reduction and flexibility are important criteria in outsourcing, but not the only ones;

- Development of FM “operational transactional focus” to a more FM management and strategic value creation for the wider business;

- IFM perceived as long term FM strategy.

Sectors like Healthcare, Education and Government are still relatively unfamiliar with IFM but the introduction of Public Private Partnerships (PPP) are slowly changing this perception, despite some less successful PPP transitions in the last 5 years (too much cost focussed or lack of competent resourcing in the management of these contracts). But over time lessons will be learned from the early PPP projects and with that from the FM failures. Further research on FM lessons learned would be very beneficial for the immature New Zealand FM market, and especially the procurement teams involved.

The growth of IFM depends on the maturity of the client organisation: C-suite as well as existing FM management, the latter often in favour of in-house self-delivery models or hybrid models. But the growth of IFM also depends on the “supply side” of professional FM suppliers which have been lacking in a clear value strategy in the last 10 years and accepting a low cost model as entry strategy, when compared with other international FM IFM service providers. And finally the damaging effect of procurement due to too much focus on short term cost savings and a lack of value driven procurement.

Limited IFM growth data in New Zealand points in a yearly 15 to 20% growth opportunity of this model in the New Zealand market but a lack of benchmark data and data reference is not very helpful. But it’s clear that IFM is building its reputation to penetrate the New Zealand FM market and way of doing business!

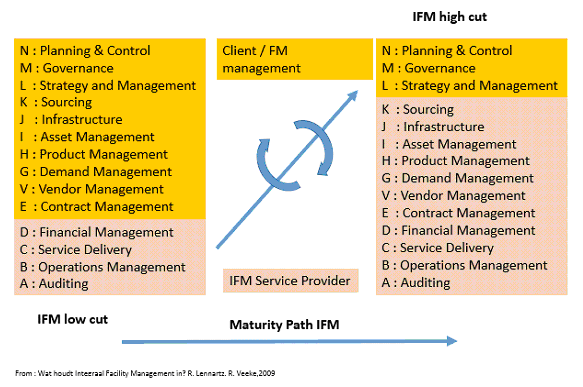

The model below clarifies the difference in a low/high cut in the management responsibility scope of IFM: operational service delivery focus or strategic FM focussed!

Parts of this article are copied of a Linkedin article by George Maas on the 9th of January 2017, managing partner at Hospitality Group in the Netherlands. Parts of that article is also published in the Dutch FM magazine “Facto”.

Jack Crutzen wrote this article as deputy chair of FMANZ as well director of PRISMA Facilities Management. In his role as consultant he regularly provides organizations with an assessment of the current FM organization and advises on future models and associated transition strategies.